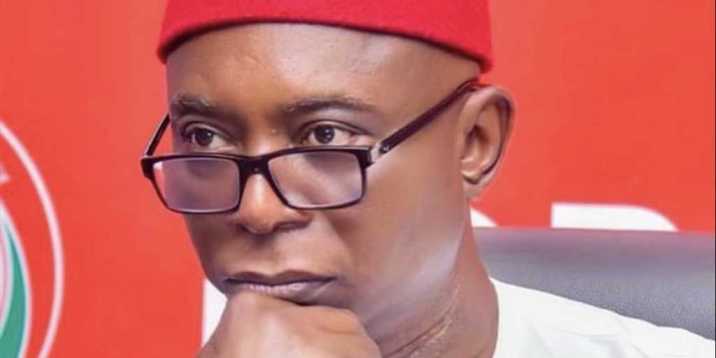

Senator Ned Nwoko (PDP-Delta) has called for urgent review of some economic policies in view of the worsening surge in inflation rate.

Nwoko who made the call while speaking with journalists in Abuja, said that the recent surge in inflation rates and the significant depreciation of the Naira, were issues of grave concern for every citizen and stakeholder investing in the prosperity of the nation.

According to him, the inflation rate, which has reached alarming levels in recent months, is a threat to the well-being of the people.

“We must take decisive action to address this concerning trend that has unfortunately become the norm.

“The nation’s economic team must urgently review and adopt effective policies to combat these challenges,”he said.

He said the CBN Governor, at a briefing at the National Assembly, among other factors, cited Nigerians schooling abroad as contributors to the high inflation rate and depreciation of the Naira.

“The assertion may have some merits but the impact of tuition expenses on the country’s foreign exchange reserves, pales in comparison to the broader systemic issues at play,”he said.

The lawmaker said that blaming Nigerians schooling abroad for inflation, and currency depreciation oversimplifies the complex factors driving economic trends.

“It’s important to acknowledge the broader systemic issues such as fiscal policy, monetary management, trade imbalances, and structural deficiencies within the economy that contribute significantly to these challenges”, he said.

He added that how effective Nigeria’s fiscal policy is, current bank rate, inflation target set by the Central Bank of Nigeria (CBN), and how frequently it is adjusted to manage inflation are very germain in addressing the issue of the surge in inflation.

Nwoko said that in the UK, inflation was primarily controlled through the monetary policy implemented by the Bank of England (BoE).

“The BoE sets an inflation target, currently at two per cent, and uses various tools to achieve it.

“These tools include adjusting the base interest rate, known as the Bank Rate, which influences borrowing costs throughout the economy.

“Additionally, the BoE engages in quantitative Easing (QE) to stimulate economic activity or contractionary measures to curb inflationary pressures.

“Moreover, the BoE monitors various economic indicators and adjusts its policies accordingly to maintain price stability and support sustainable economic growth. Can we say same about Nigeria?”, he asked.

He said that one adverse structural deficiency influencing economic trends in Nigeria, was the excessive importation of non-essential goods and locally producible items.

He explained that dependency on imported goods, particularly those that can be readily produced within the country, undermines domestic industries and erodes the foundations of economic self-sufficiency.

He added that this dependence would continuously subject the nation’s economy to external shocks, exacerbating the Naira depreciation if no resolute action was taken.

“Decisive action must be taken to address the root causes of this continuous free fall of the Naira and persistent trade imbalances.

“As I have consistently maintained, there is a compelling need to restrict the importation of non-essential goods and locally producible items, with the view of promoting local production.

“Nigeria has the manpower and raw materials needed to lay the groundwork for a more self-reliant and prosperous future through production.

“Redirecting funds previously earmarked for importing non-essential goods to support and incentivise local manufacturers and entrepreneurs will be crucial.

The lawmaker also said that another structural deficiency exacerbating the depreciation of the Naira, was the practice of paying foreign workers in companies situated in Nigeria in foreign currency.

He explained that the practice not only undermines the dignity and rights of Nigerian workers, but also puts pressure on the nation’s foreign exchange reserves, thereby destabilising the Naira.

“The effect has proven to be detrimental; hence, there is a compelling need to pay foreign workers in companies situated in Nigeria in Naira.

It is a roadmap for strengthening control over our monetary policy and reducing pressure on reserves.

“These are the broader systemic issues that must be addressed to control the inflation rate, maintain price stability, and support sustainable economic growth”, Nwoko said.

He further said that the reliance on the USD must cease, adding that “as long as we tether everything to the dollar, we remain ensnared by colonial powers.

“This is non-negotiable. We must relentlessly pursue economic independence,” he said .